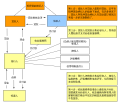

File:Borrowing Under a Securitization Structure zh-hant.svg

此SVG文件的PNG预览的大小:606 × 526像素。 其他分辨率:277 × 240像素 | 553 × 480像素 | 885 × 768像素 | 1,180 × 1,024像素 | 2,360 × 2,048像素。

原始文件 (SVG文件,尺寸为606 × 526像素,文件大小:29 KB)

文件历史

点击某个日期/时间查看对应时刻的文件。

| 日期/时间 | 缩略图 | 大小 | 用户 | 备注 | |

|---|---|---|---|---|---|

| 当前 | 2009年2月3日 (二) 00:38 |  | 606 × 526(29 KB) | Zanhsieh | fix utf-8 format error caused by inkscape |

| 2009年2月3日 (二) 00:30 |  | 606 × 526(27 KB) | Zanhsieh | {{Information |Description={{en|1=Borrowing Under a Securitization Structure Issuer - A bankruptcy-remote special purpose entity (SPE) formed to facilitate a securitization and to issue securities to investors. Lender - An entity that underwrites and fun |

文件用途

以下页面使用本文件:

全域文件用途

以下其他wiki使用此文件:

- en.wikipedia.org上的用途